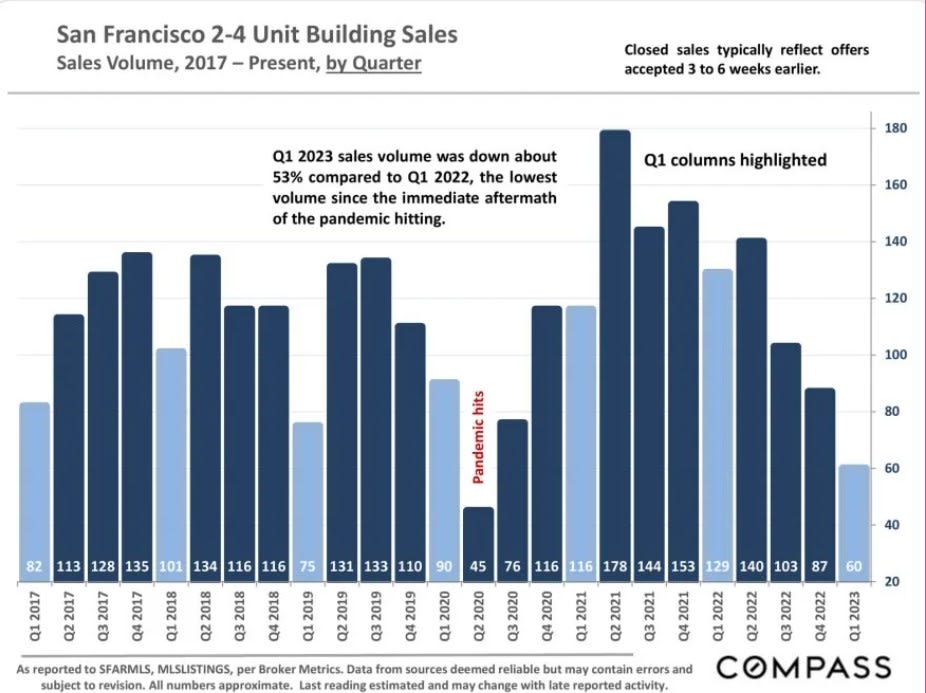

The environment in the San Francisco multi-family market continued to be challenging the first quarter of 2023 due to both local issues and national factors, with a drop in quarterly sales volume rivaling the plunge seen in the immediate aftermath of the pandemic hitting in early 2020.

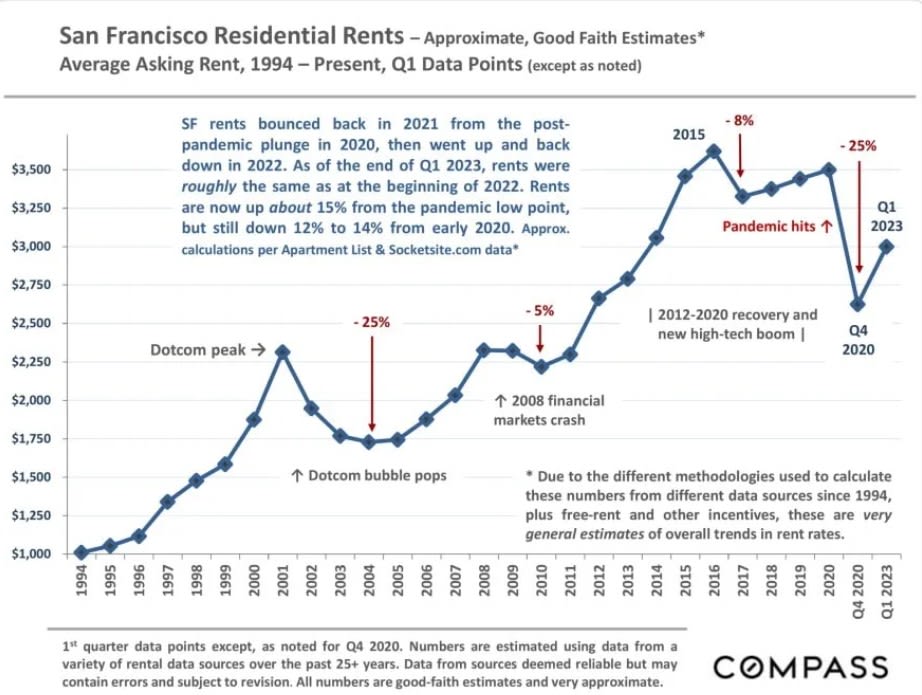

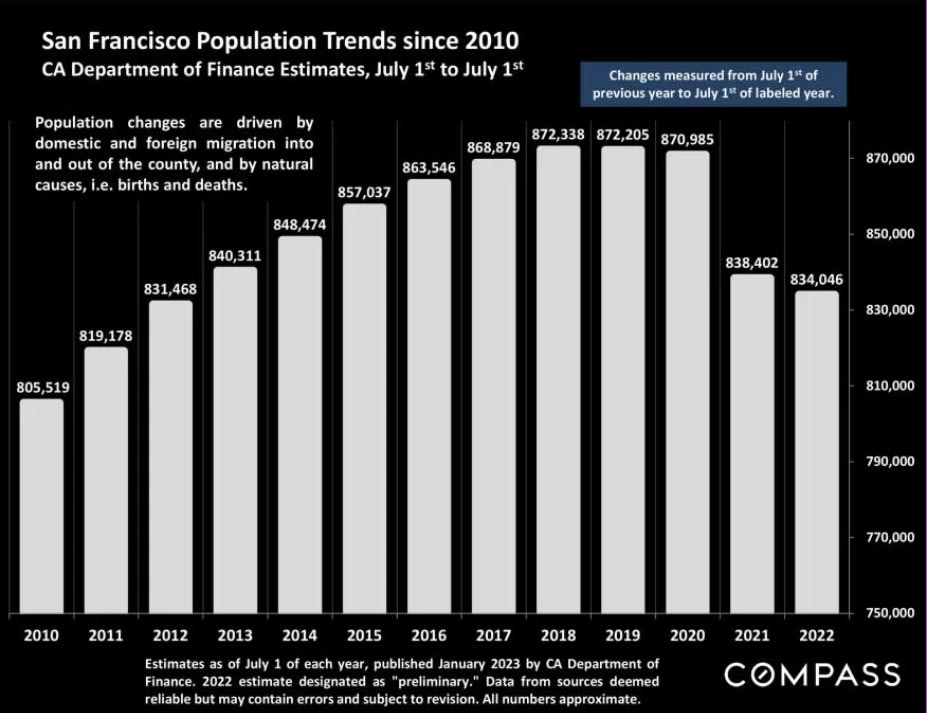

Local factors include high-techs layoffs, half-empty office buildings, a continued decline in population in 2021-2022 (though the decline is much reduced from the previous 12-month period), and various social/political issues. Interest rates remain more than twice as high as at the start of 2022. According to Apartment List, average asking rents in San Francisco climbed in the first half of 2022, but dropped back down, erasing the gain, in the second, and have ticked down further, slightly so far in 2023: Rents remain well below pre-pandemic rates. The recent banking crisis, which caused the collapse of Silicon Valley Bank and ongoing uncertainty with First Republic Bank among others, is reportedly making it more difficult to buy properties as lenders pull back or raise rates.

According to the Wall Street Journal, quoting data published by Co-Star, national sales of multi-family buildings in Q1 fell at the fastest rate since 2009. The WSJ also reported that, according to the MSCI Real Assets pricing index, national multi-family prices dropped 8.7% in February on a year-over-year basis (with another source estimating a much sharper drop).

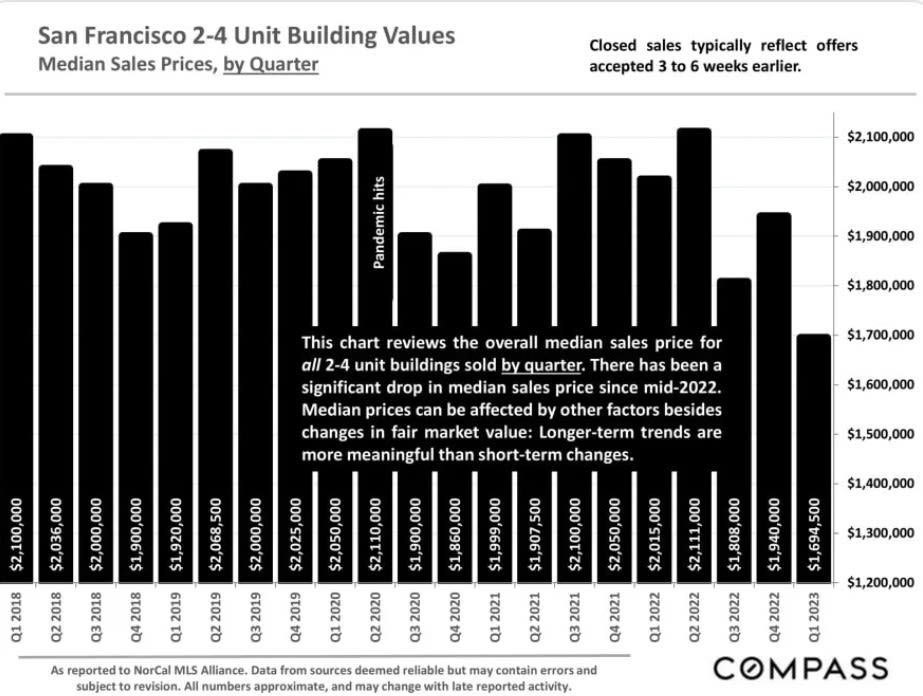

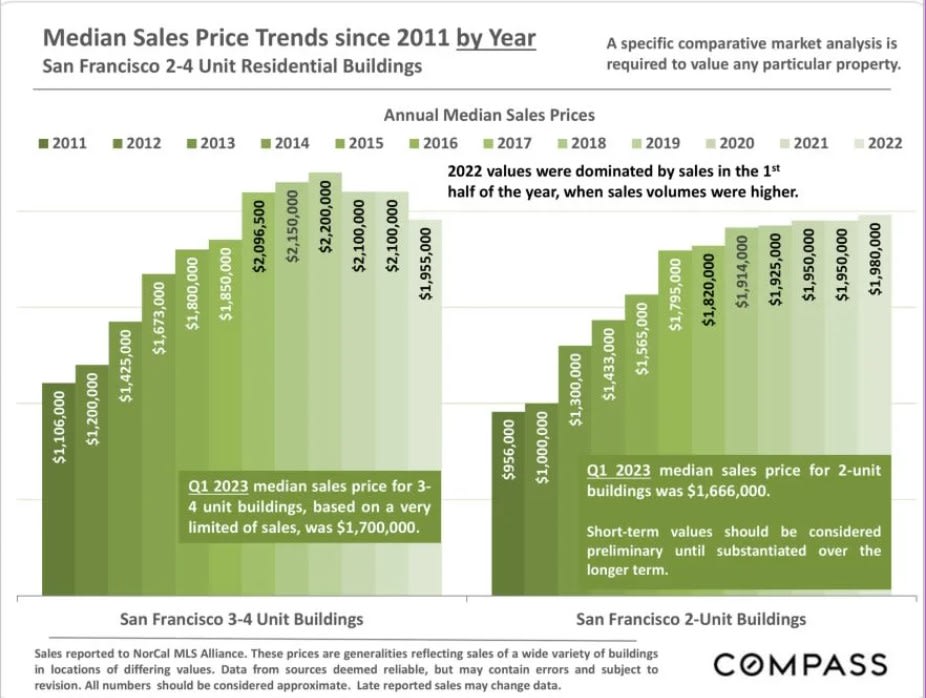

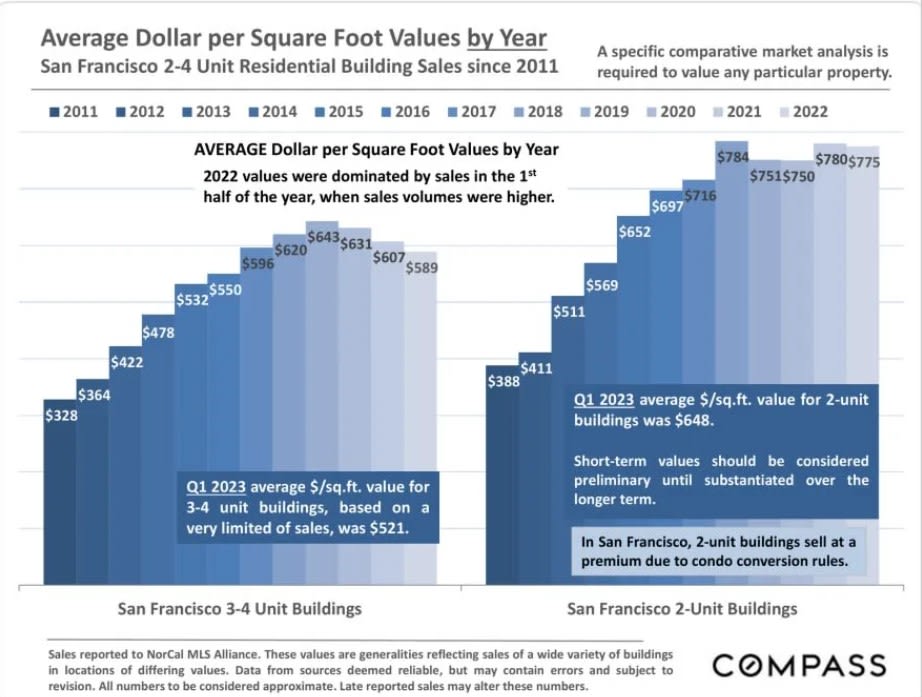

As illustrated in this report, median sales prices and average dollar per square foot values for SF 2-4 unit, multi-family buildings showed significant declines in Q1, dropping 15% to 16% on a year-over-year basis, continuing the trend - similar to that seen in the general residential market - which began in mid-2022. These value metrics should be considered preliminary until substantiated over the longer term. Typically, sales activity climbs rapidly in Q2, and should give us much more data.

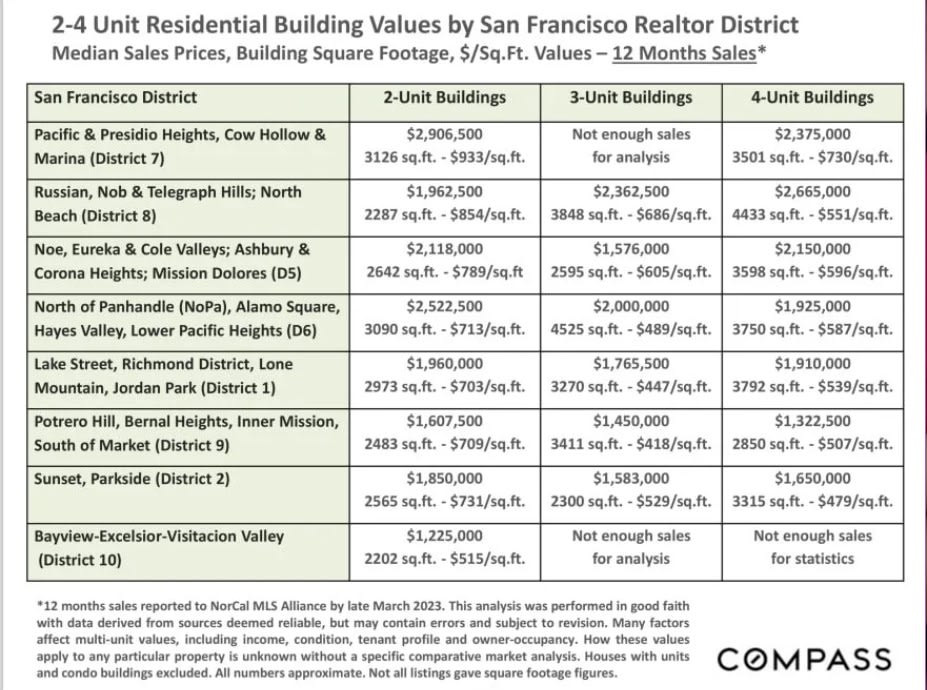

Data reported to regional MLS associations. Q1 2023 numbers are estimates using data available in early April 2023: Late reported sales may alter these numbers. Statistics are generalities, essentially summaries of disparate data generated by unique, individual sales. They are best seen not as precise measurements, but as broad, comparative indicators. Anomalous fluctuations in statistics are not uncommon, especially in smaller market segments with fewer sales. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. How these figures apply to any particular property is unknown without a specific comparative market analysis.

San Francisco 2-4 Unit Building Sales

Sales Volume, 2017 - Present, by Quarter

Closed sales typically reflect offers accepted 3 to 6 weeks earlier.

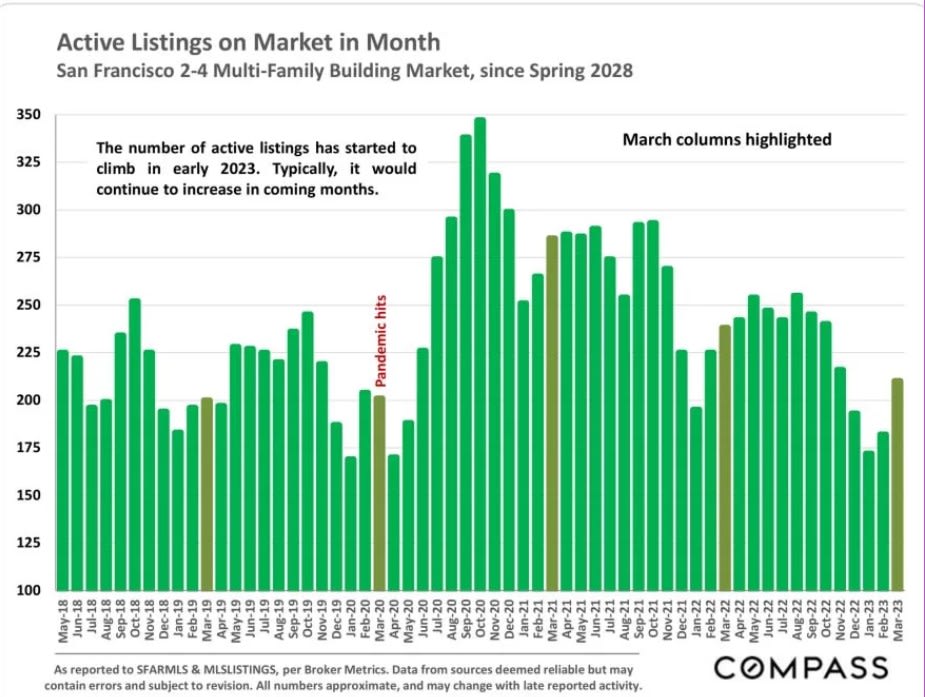

Active Listings on Market in Month

San Francisco 2-4 Multi-Family Building Market, since Spring 2028

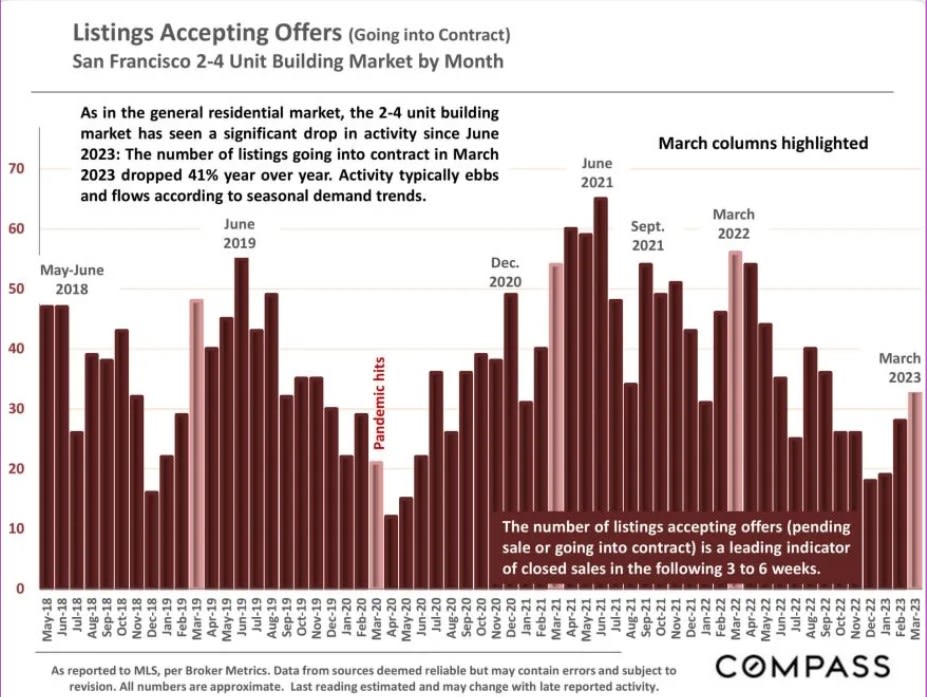

Listings Accepting Offers (Going into Contract)

San Francisco 2-4 Unit Building Market by Month

San Francisco Residential Rents - Approximate, Good Faith Estimates*

Average Asking Rent, 1994 - Present, Q1 Data Points (except as noted)

San Francisco 2-4 Unit Building Values

Median Sales Prices, by Quarter

Closed sales typically reflect offers accepted to 3 to 6 weeks earlier.

Median Sales Price Trends since 2011 by Year

San Francisco 2-4 Unit Residential Buildings

A specific comparative market analysis is required to value any particular property.

San Francisco 2-4 Unit Building Values

Average Dollar per Square Foot Values, by Quarter

Closed sales typically reflect offers accepted to 3 to 6 weeks earlier.

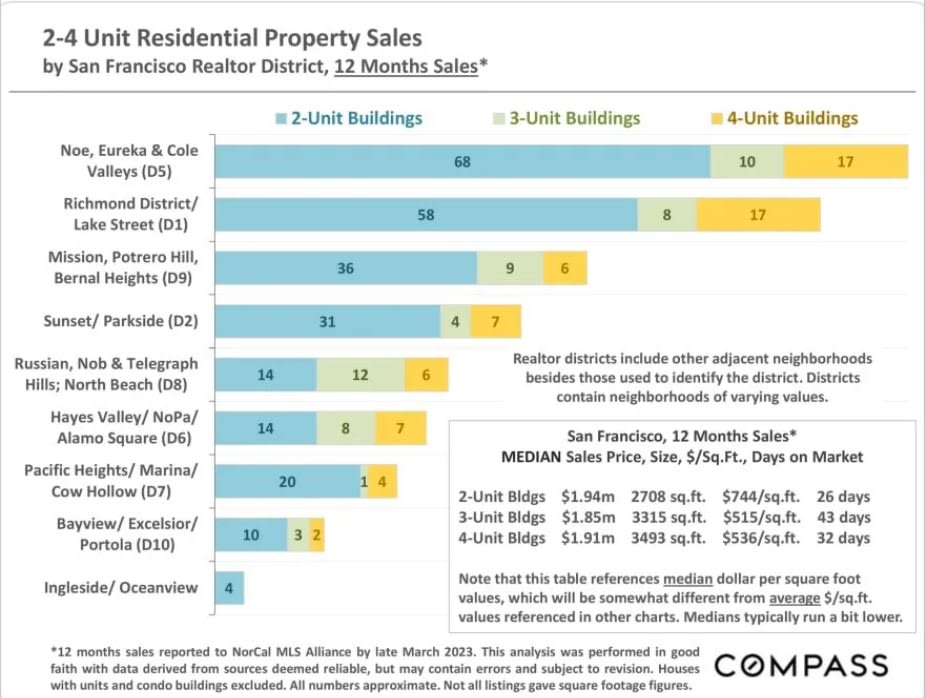

2-4 Unit Residential Building Values by San Francisco Realtor District

Median Sales Prices, Building Square Footage, $/Sq.Ft. Values - 12 Months Sales*

2-4 Unit Residential Property Sales

by San Francisco Realtor District, 12 Months Sales*

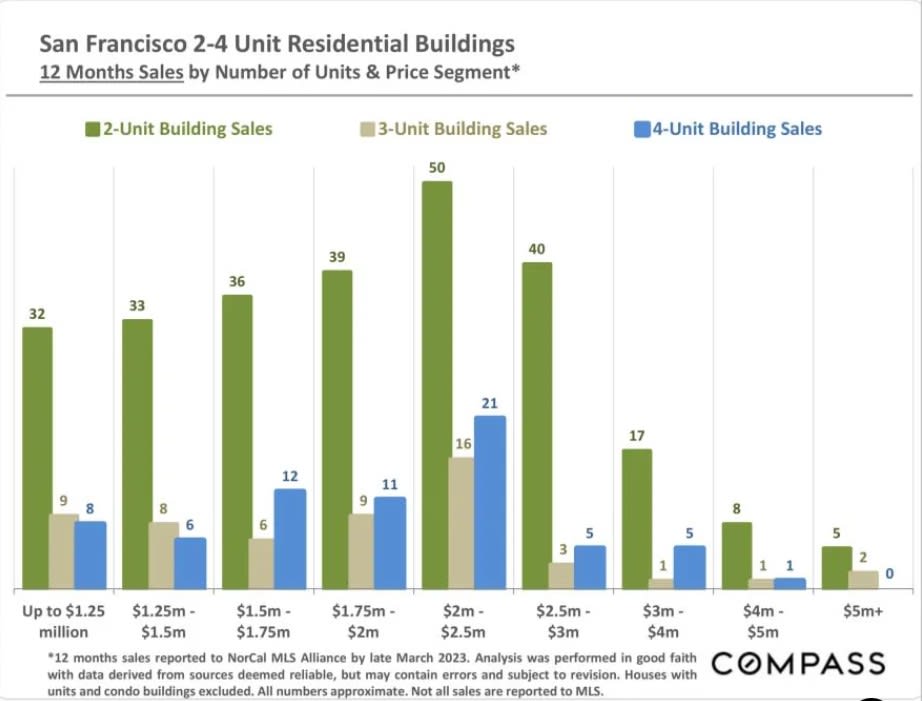

San Francisco 2-4 Unit Residential Buildings

12 Months Sales by Number of Units & Price Segment*

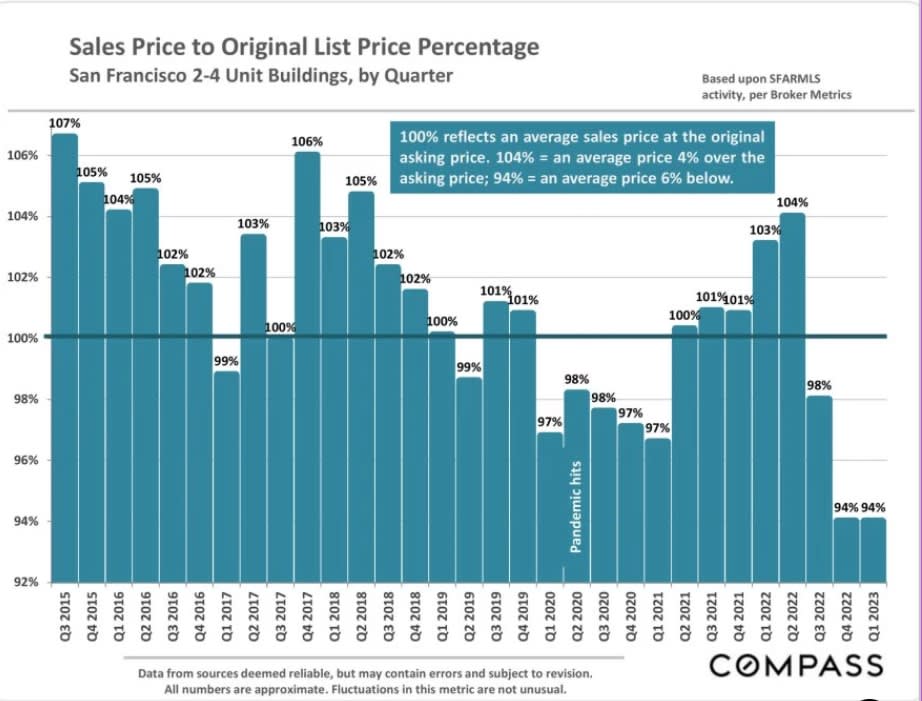

Sales Price to Original List Price Percentage

San Francisco 2-4 Unit Buildings, by Quarter

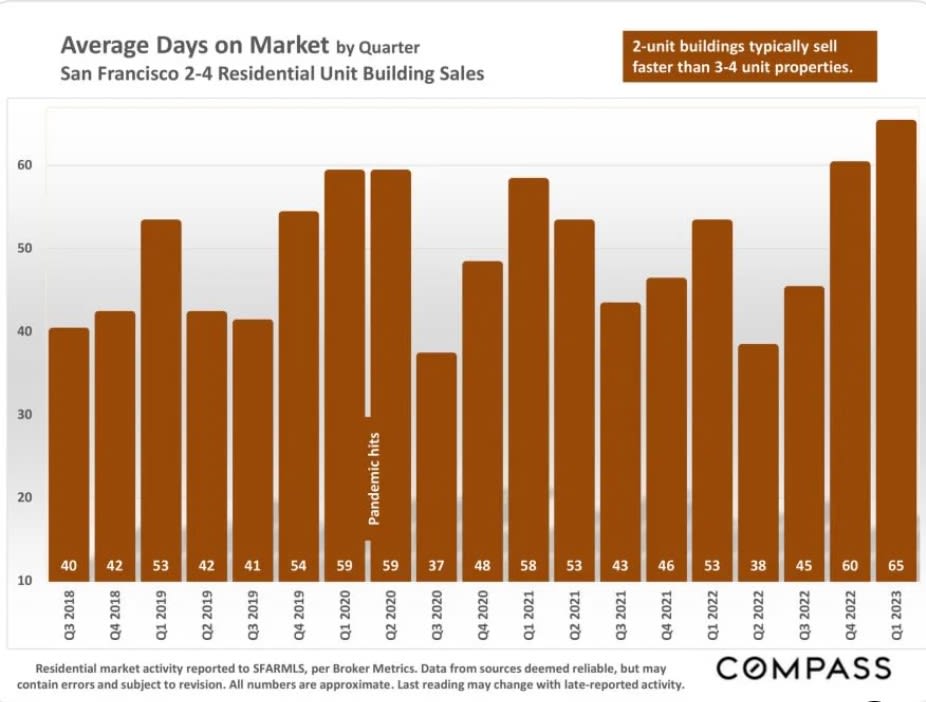

Average Days on Market by Quarter

San Francisco 2-4 Residential Unit Building Sales

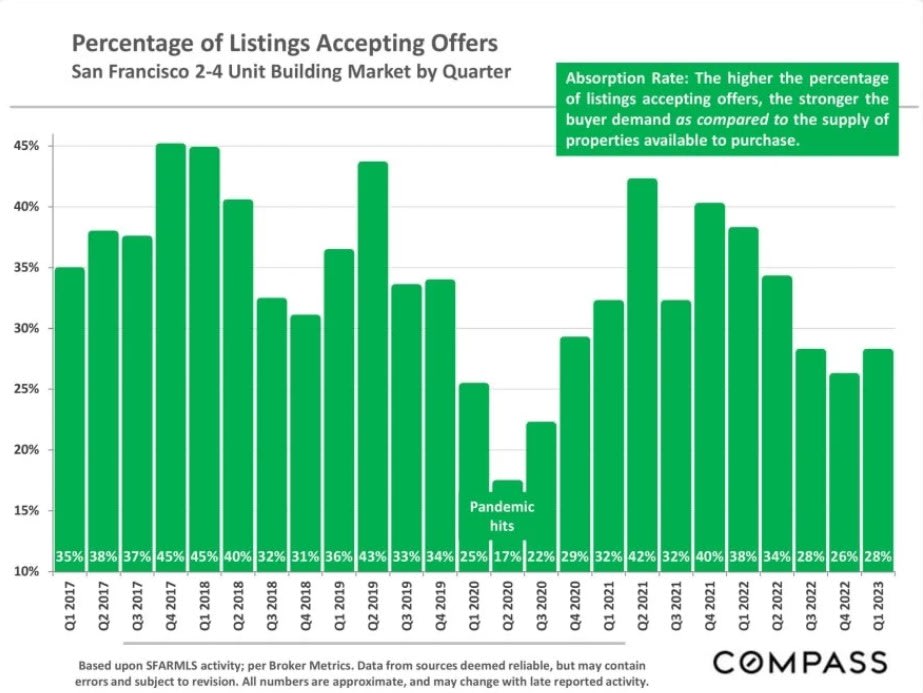

Percentage of Listings Accepting Offers

San Francisco 2-4 Unit Building Market by Quarter

Absorption Rate: The higher the percentage of listings accepting offers, the stronger the buyer demand as compared to the supply of properties available to purchase.

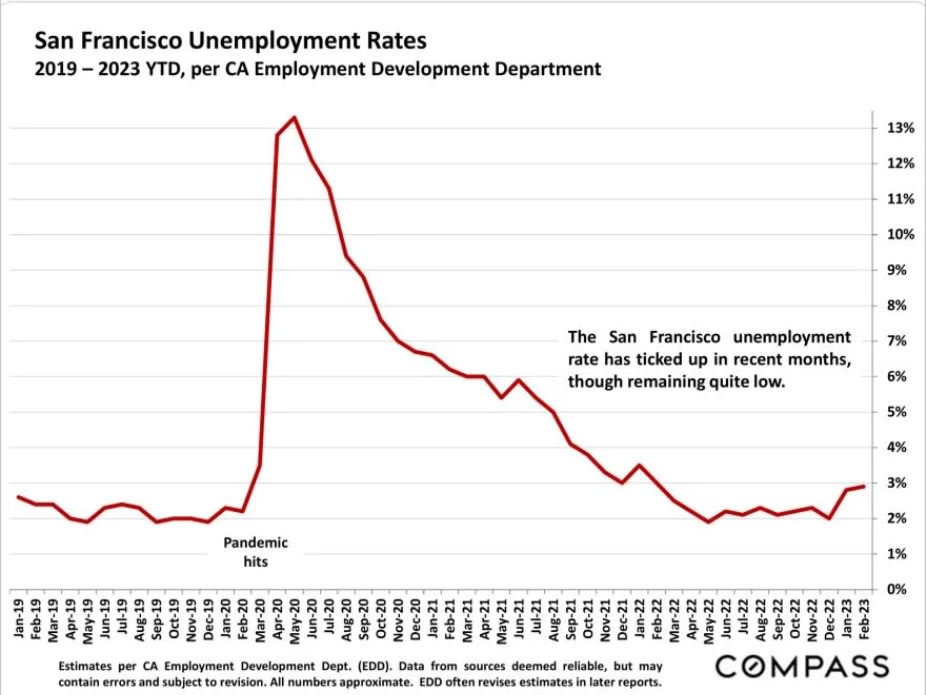

San Francisco Unemployment Rates

2019-2023 YTD, per CA Employment Development Department

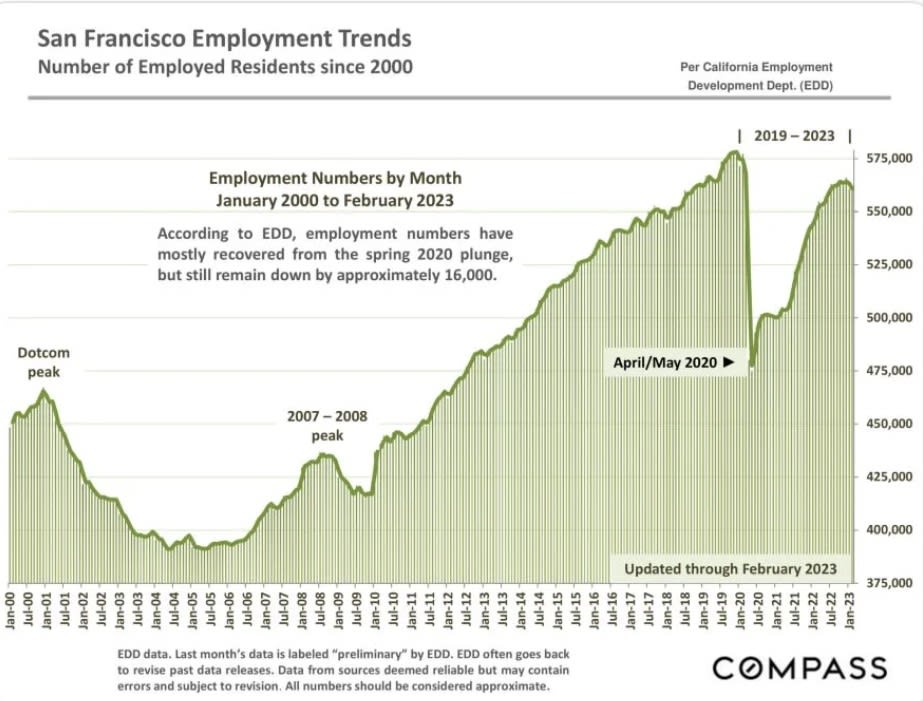

San Francisco Employment Trends

Number of Employed Residents since 2000

San Francisco Population Trends since 2010

CA Department of Finance Estimates, July 1st to July 1st

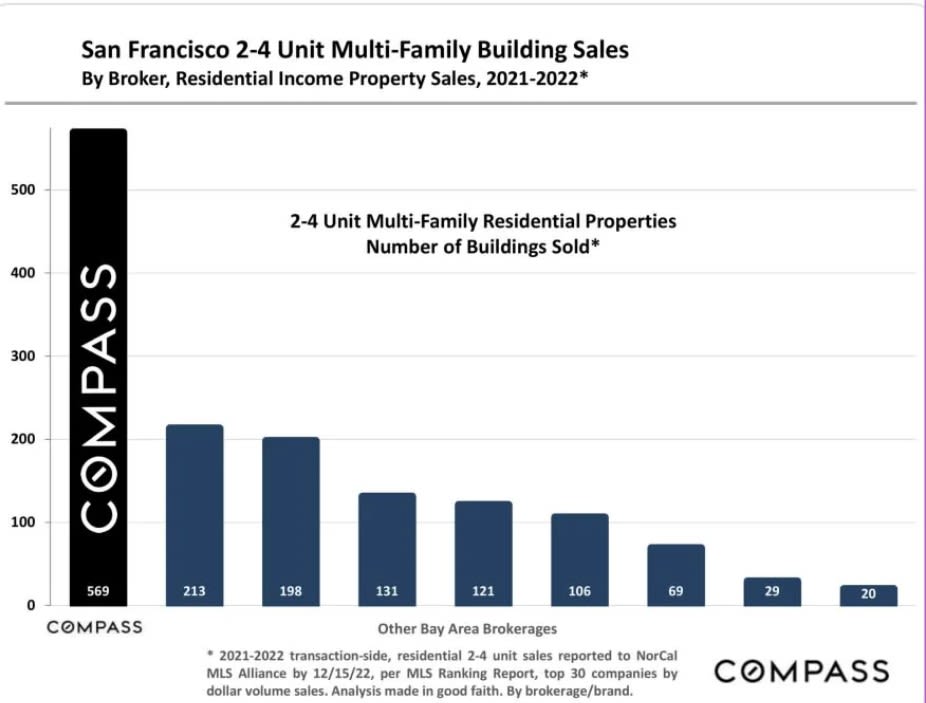

San Francisco 2-4 Unit Multi-Family Building Sales

By Broker, Residential Income Property Sales, 2021-2022*

Note that the quantity of sales in any given local submarket is usually relatively small and/or the number of sales that report the necessary financial information can be limited. Buildings of different ages, qualities and sizes selling in different periods can cause these average and median figures to fluctuate significantly. Furthermore, the reliability of some of these calculations depends upon the quality of the Income and expense figures provided by the listing agents, and sometimes instead of actual numbers, much less meaningful projected or scheduled figures are used. Therefore, the above statistics should be considered very general indicators, and how they apply to any particular property without a specific comparative market analysis is unknown.

These analyses were made in good faith with data from sources deemed reliable, but they may contain errors and are subject to revision. Statistics are generalities and all numbers should be considered approximate.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and ail lability relating to this report, including without imitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained heroin is intended to be or should be read as any regulatory, legal, fax, accounting or other advice and Compass does not provide such advice. Al opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.